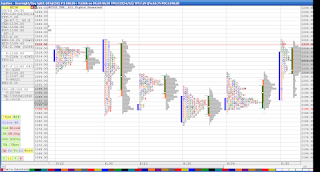

The last two sessions has been balancing in a 20 point value area which is a break from the volatility. The 1225 level in the S&P 500 Emini is holding as a price rejection level. The market spent a lot of fuel yesterday on the buy side without getting much liftoff early on. That is a sign of temporary price acceptance of multi-time frames. Everybody is waiting on the word from the Hill on the bailout package. The market is preoccupied. There is still sign of mild accumulation as we entered the mid morning net delta positive. A moderate sign of price getting some responsive buyers. We are building additional TPO count in the upper distribution of the 3 day profile. Key area to watch is again- the 1225 and the 1187-1191 area overnight. Key to trading days like these is not to get killed by a thousand pricks. Taking very selective 2-3 trades and living with it. I was biased to the upside based on the delta but we did not test the 1225 level although we rotated through yesterday's value. The market just does not have the ammo quite yet. As we have seen in the past few sessions, any strong move in either direction will be preceded by a strong flushing move in the opposite direction. Sometimes small time players like us need to stay out.