Imagine you are driving in a car, talking on the phone or pondering about something.

You are doing 50 miles an hour in a 40mph road. You are about 100 yards or so from the traffic light just as it turns yellow. Do you speed up or do you hit the brakes... that was a scenario I heard on NPR about a month ago on the program on the traffic dilemma zone. It was referred to as the dilemma zone for brain where it has to make a split second decision whether to make it or stop. I caught maybe 5 minutes of it so I cannot elaborate much. I cant find the recording either. I suspect at that moment the motor cortex takes over control on the decision. It calculates if you are going to make it or not, based on the visual information it is receiving. I think this is much simpler primal process but a good comparison to what we encounter everyday in trading.

Now imagine you are about to enter a long position today in the E period today. You have been waiting for a retrace all morning so you could get on the train. However, instead of a normal retrace, the market makes a steep dive down to approximately your level. You have been analyzing the rest of the markets, news and parameters to see if anything has changed to the long bias - it hasn't. But at the moment the price makes a steep dive to your entry location, you are in a dilemma zone, I suspect. I have fear that the momentum may take it further through me, perhaps the next major level. I have greed to be on the train.

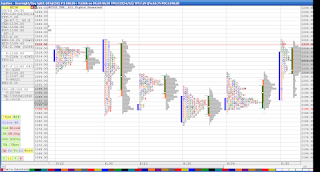

I wrote my premise of my trades and bias today in my last blog. Again to recap. The market makes a strong open drive during A period opening above POC, value, range and the previous levels of resistances. The opening price is bought up on subsequent periods. Strong delta, strong big money delta as well. Price has stopped at strong resting bids @ 6:55, 7:11, & 7:28. Dominant flow is the first 2 bars (reversal of selling pressure). Then we have another at 7:56.

I entered my bid at 1289 at the 8:44 bar after it ticked up from the low just as I notice selling pressure subside significantly and a big block of order trade on the ask (confirming the show of hands @ 7:56) . It was VWAP as well. But by the time my bid was on the dome the market was at bid 1289, I was fighting the market already. I did'nt take the ask. I had maybe less than two or three seconds to take it. I wanted that tick. One of the main reason was that I wanted to stay at the bottom edge of the initial balance and give it a 2 point stop intially, then switch to a mental stop. But I think the bigger reason was because I was mentally in fight mode already. It is what I am calling the trading dilemma zone - when you make a decision to enter a trade. However I think there is a lot more involved to it than that. I don't remember being afraid so much as unwilling to take a higher price and then soon enough my unwillingness to chase (self trained) kicked in. In a matter of couple of seconds the time place opportunity was gone.

I would pose this question to Dr. Steenbarger and see what has to add on how to deal with this zone mentally. His blogs on trading psychology has been of great help. On the managed exit side of things there are couple of good

articlesThey are similar in nature I suppose yet need different strategies.

I did end up buying the 1st standard deviation of VWAP at 1294 in the J period for a much smaller trade. I thought I was lucky to get that retrace ( see prior midday update) because on days like this retraces can be very shallow. I did end up taking profit earlier because I caught myself dozing from the flu medication at one point (that much action today). I figured they don't let u drive (a much simpler activity) under medication, I might as well as preserve the profit towards trading costs and stop trading.

It is important to me to get the first great opportunity so I don't have to take a make up trade. I would rather be adding than initiating. I hope nobody took the short side of the market today. I posted the advise against shorting today from my well ingrained traumatic memories stored in permanent memory in my brain.